Back in the day, when you needed a loan to pay for your car maintenance or credit cards, you would visit a bank or credit union, meet with a loan officer, and wait for them to accept or most probably reject your request.

Peer-to-peer (P2P) lending, however, has just entered the market and offers loans to borrowers directly from individuals – typically with more favorable terms for those without a strong credit rating. Lenders offer borrowers access to funds that can reach up to $5,000, with fixed term repayment plans and affordable interest rates. On P2P platforms, investors can also take on the role of lenders and earn interest on loans as a passive source of investment income.

Advantages of using P2P Money Lending Apps for Lenders

-

Access much higher rates of returns on loans

Investors would have the opportunity to obtain a greater rate of return through P2P money lending applications compared to other market-available investments like bonds or deposit accounts.

-

The degree of risk can be chosen by lenders.

Using the app, investors may choose the risk level they choose for the types of borrowers they would lend money to.

How Lenme is the game changer!

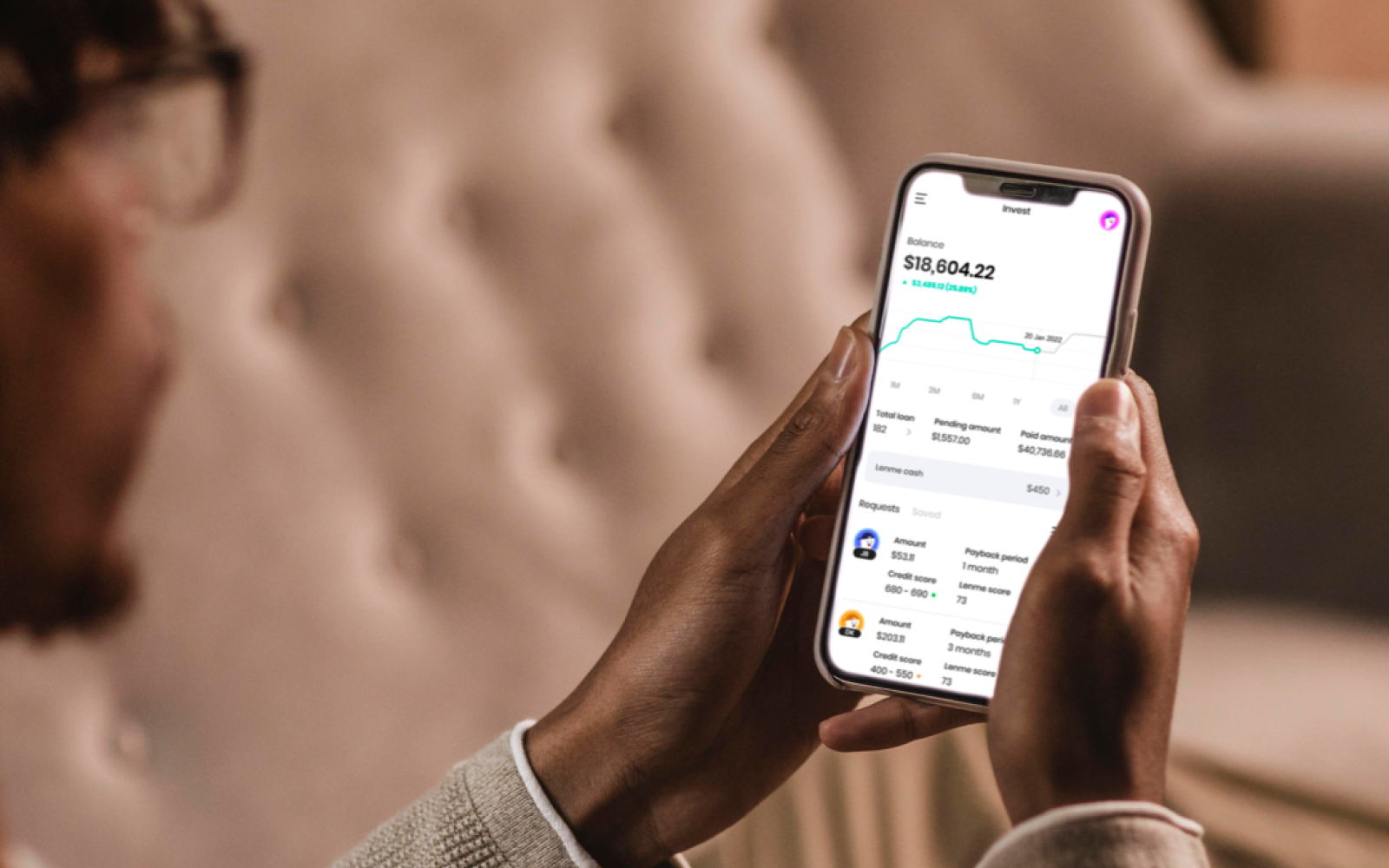

Users interested in this kind of investments can find dozens of apps today offering personal loans. However, Lenme has added new unique and new features for investors interested in funding loans and generating good cash returns.

-

Gain Unique Access to Data

Investments with knowledge always pays-off. You can easily view Borrowers’ profile data to wisely choose who you want to lend money to. Lenme gives investors access to more than 2,000 data points, including income, aggregated banking data, payment history, and information from credit reports, all of which may be used to make an informed investment decision.

-

Investors are in Total Control

By deciding the Interest rates & returns, you can earn more cash in the process. Investors have easy access to loan requests submitted by borrowers on the app and then decide who they want to lend money to based on their profile data. No investment minimums, or withdraw fess. Fund as little or as much as you want and on your terms!

-

Even First-Time Investors can also Earn

No need to worry! With the help of Artificial Intelligence and Machine Learning Algorithms, Lenme is offering a uniquely designed service called Lenme Predict. Never found in any other App to help guide Investors towards the most profitable and best returns. We consider it to be your new investing friend.

Now it’s time to Earn!

Once you start connecting your bank to the app and start funding loans, Lenme will handle everything! The app will be automatically transferring money to your bank account & you won’t need to carry the hassle. Investors can also withdraw funds at any time with absolutely no Cost!!

There you have it – investing with Lenme is as simple as that! Give it a try – download the app here.