In a modern era of technology, almost everything today is digital. Lenme has gone one step further and developed a technology that makes P2P lending possible. If you’ve never heard of Lenme or peer-to-peer lending, we have built a new platform where we can connect lenders to borrowers and make personal loans much easier. Offering competitive interest rate options in contrast to banks, credit unions, and payday loans.

What is really unique about Lenme!

Lenme is a free market platform that connects people wishing to invest and people looking to borrow money. The definition of the free market Interest rates are set by consumers in a free market, not by banks, underwriters, or any other external influences. The borrower has the option of accepting the investor’s rate for the loan or looking for a different one. While offering investors amazing features that will help them invest smarter and earn more money in the process.

Why should you invest in loans with Lenme?

Introducing 6 amazing investing features

- As an investor, you can choose who you want to lend money to

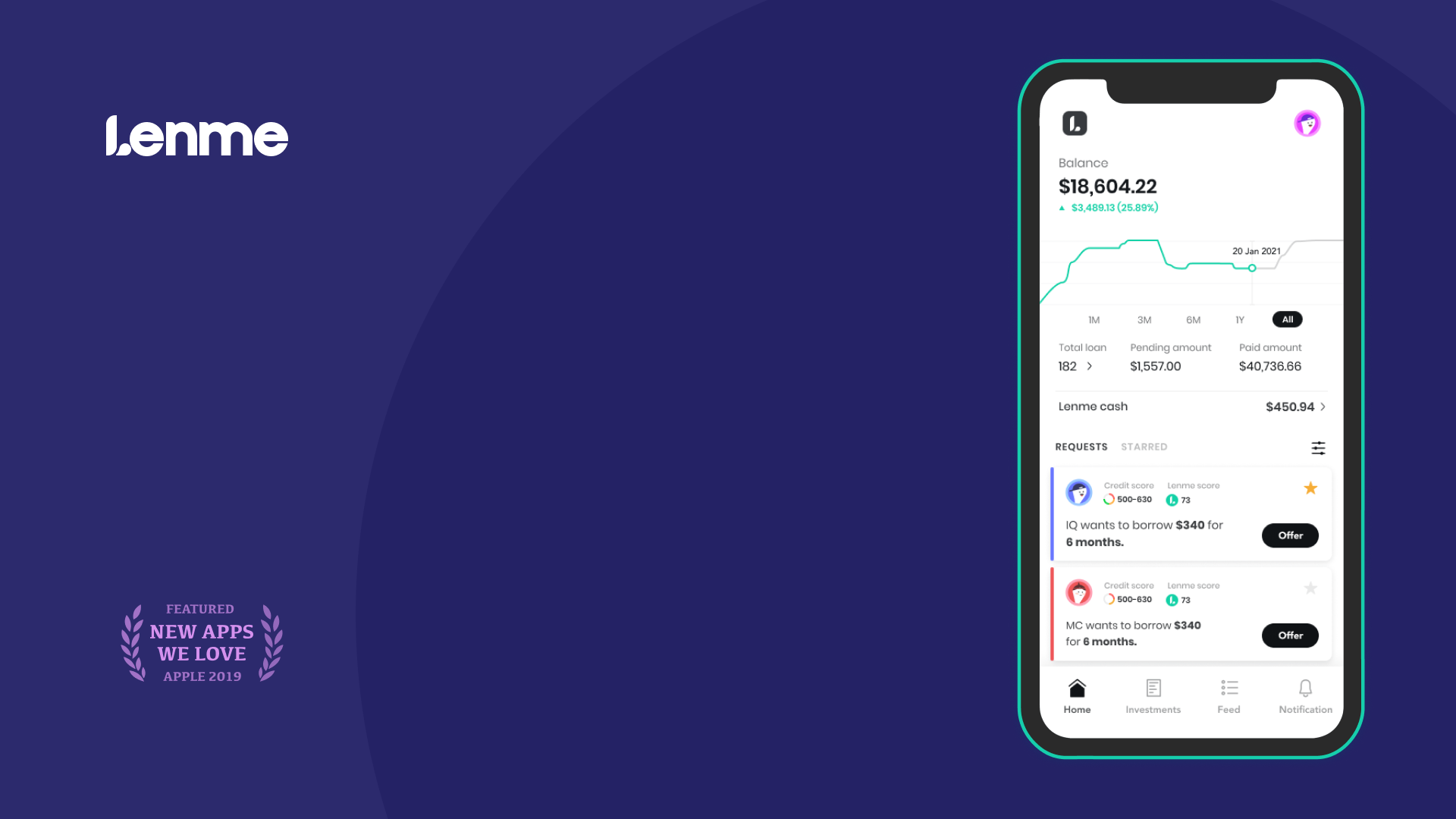

With Lenme, transactions are 1-to-1, meaning that one lender is funding one loan. As an investor, you can choose who you want to lend money to and how much money you would like to lend.

To help you assess investment opportunities, which range from $50-$5000, we provide each borrower’s credit report information and Lenme borrowing history. From there, you can gauge the risk of the transaction and choose the appropriate interest rate you would like to offer. Simple enough, right?!

- Not all of your eggs are in one basket

Investors have unique access to thousands of qualified borrowers looking for funds. The different borrower profiles can be examined by investors, who can then contrast them with other requests. Depending on the individual’s comfort level, it is advised that investors invest in a varied range of investments that are a combination of low, medium, and high risk.

- Investors choose their own interest rate & earnings

Being in control of the return you want is what really sets Lenme apart from other investment options. With the free market at play, interest rates will be determined by supply and demand. Borrowers will be looking for the best interest rate they can get. If you continue to make offers and get declined, consider lowering the interest rate you are offering. The “Feed” tab within the app will help give you an idea of what similar loans are going for.

4. Invest Smarter with Lenme Predict

Because we believe that Investments with knowledge pay off! We have been working on brilliant algorithms in the Lenme Predict service that will help you get better analysis and data on Borrower’s profiles to earn more money while investing wisely.

5. Both experienced & new lenders can earn high returns

Are you an experienced lender? You have access to over 2,000 data points to make an informed investment decision, including credit reporting data, aggregated banking data, income, and payment history. Are you new to lending? No problem, you can Lenme’s machine learning algorithms that will predict the borrower’s risk profile.

6. Invest in almost risk-free Crypto-backed Loans

Introducing the new Lenme Crypto-backed loans, generate higher returns in almost 0% risk investments. Users can now invest their money in funding loans backed up by crypto-currency where borrowers connect their crypto wallet before requesting loans.

There you have it – investing with Lenme is as simple as that! Give it a try – download the app here.